How dangerous hobbies can affect life insurance rates

Rachel Hartman

Jumping out of planes, scuba diving, and deep sea fishing can lead to more than weekend thrills. They may also affect what you’ll pay when you take out a life insurance policy.

“There are dozens of dangerous hobbies and lifestyle activities that can increase insurance rates,” says Joel Winston, a former deputy attorney general for the state of New Jersey, and now a New York-based attorney who founded AnnualMedicalReport.com, an online source where insurance applicants and policyholders can request copies of their medical reports.

That’s because some hobbies, such as sky diving, are considered to put your life at risk. In 2012, the United States Parachute Association recorded 19 fatal sky diving accidents in the U.S., out of roughly 3.1 million jumps.

That’s because some hobbies, such as sky diving, are considered to put your life at risk. In 2012, the United States Parachute Association recorded 19 fatal sky diving accidents in the U.S., out of roughly 3.1 million jumps.

While this statistic may seem low, sky diving is generally seen as an activity that brings a higher rate of life-threatening risks than other pastimes, like hiking or playing tennis. If you sky dive regularly, you could pay up to an average of $2,500 more per year for a $500,000 life insurance policy, Winston says.

Other activities, such as boating, may not seem as dangerous. In 2011, however, the U.S. Coast Guard counted 4,588 accidents that involved 758 deaths.

Factors such as how often you participate in the hobby are considered when calculating your premium.

What is a dangerous hobby?

When it comes to life insurance, “companies take on risks differently, and also define risk differently,” says Cesar Lopez, Jr., a financial advisor in Miami. This means that while one company may consider a certain pastime to be dangerous, another might not. For instance, some insurance companies might raise a red flag if an activity such as boating regularly comes up during the life insurance application process. Another company, however, might not consider it to be a dangerous hobby.

When filling out a life insurance application, you’ll be asked general questions about risky activities, says Lopez. These activities can vary from company to company. On the application, you might see questions about scuba diving, racing, aerial activities (like sky diving), mountain climbing, bungee jumping, or cave exploration.

Also, some insurance companies view hunting, fishing, and motorcycle riding as dangerous, Winston says.

Skiing, surfing, and whitewater rafting, could also be considered dangerous activities, especially if they’re done for more than recreation, says Tom Koziol, owner of Accurate Insurance Services, an insurance agency in Nevada. If you regularly compete in downhill ski races, you may pay a higher rate than if you go skiing once a year.

How to buy life insurance if you participate in a dangerous hobby

Here are four factors to keep in mind when you buy life insurance if you participate in a dangerous hobby.

1. Understand that frequency matters.

Participating in certain recreational activities only on occasion may not cause your rates to go up.

For instance, if you rent a boat on a lake for an afternoon once or twice a year, it probably won’t affect your life insurance rates, Winston says. The same is true of other hobbies, such as white water rafting or surfing.

Policies also take into account one-time, unexpected events, Lopez says. For instance, say you have never gone bungee jumping and don’t plan to ever participate in the activity during your lifetime. You fill out your life insurance application stating this, and receive a policy. “Then two weeks later at your cousin’s birthday party everyone goes bungee jumping and you decide to do it too,” Lopez says. “If something happens and you die, that would be covered by insurance.”

2. Expect to pay higher rates.

If you participate in extreme activities, insurance companies may add a flat extra to the premium, says David Beck, partner at Egan, Berger & Weiner, LLC, a firm specializing in financial planning, near Washington, D.C. This extra is usually an additional cost per thousand dollars for a period of time, such as $5 per thousand dollars for five years.

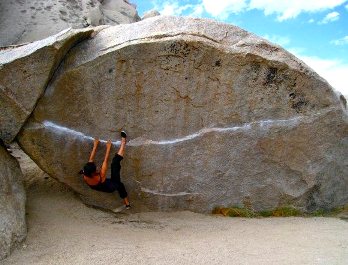

Say you regularly go rock climbing and want to take out a $500,000 policy. You purchase a 10-year term policy, and the premium is $1,000 each year for people with no risky activities. Since you rock climb, you’ll pay an additional $5 per $1,000 for five years. That comes to an additional $12,500 that you’ll need to pay over the five-year period.

Once you’ve paid the premium extra for the five-year period, you’ll pay $1,000 a year for the remaining five years. This structure, with the additional amount charged for only a specified timeframe, such as five years, is the most common method for life insurers to protect themselves, Beck says.

3. Understand the contestability period.

Life insurance policies come with a contestability period, which usually lasts one or two years. If, during this time, the insurance company believes you didn’t reveal accurate information on your application, it can cancel your policy and return the premiums you’ve paid. It can also deny a claim during that time.

After the contestability period, the insurance company will pay out a claim, with the exception of fraud, says Gregory Alerte, managing director at Gregory & Company Comprehensive Wealth Management, LLC, in Woodbury, New York. Say you go sky diving once a month, but state on your life insurance application that you’ve never gone sky diving. If you die in a sky diving accident, the insurance company might not pay the claim.

4. Recognize you might be denied coverage.

Sometimes an insurance company might feel there isn’t a certain level of premium that can be charged to cover the risk of the activity, Beck says. This may be the case with extreme hobbies, such as maximum depth scuba diving.