Do You Always Need a Police Report After an Auto Accident?

It’s a surefire way to ruin a day: an auto accident. Not only do you have to deal with the hassle of a damaged car, but waiting around the accident scene to file a police report can eat up a good chunk of your day.

But what if no one was injured in your accident, and both cars are drivable? Is it OK for you and the other driver to leave the scene without calling the police and filing a police report?

This option might be tempting, especially after you and the other motorist have already swapped contact and insurance information. But attorneys who handle auto accident cases say that not filing a police report can be a big mistake, a potentially costly one if you are the driver who was not at fault in the accident.

RELATED: 13 Faculties That Diminish as You Age

Ira Maurer, founder of Maurer Law Firm and a personal injury attorney in Poughkeepsie, New York, says that the police report documents the conditions and probable causes of an accident. Leaving without filing one, even when both drivers in an accident agree to do this, might result in a lower insurance payout to you, Maurer said.

“That can significantly affect your ability to obtain reimbursement for the damage to your vehicle and monetary damages for your injury,” Maurer says. “Protecting this important record by speaking to the police at the scene and providing detailed information about the accident and your injuries will be critical to your claim.”

Why a police report after a car accident matters

Jody McKnight, founder of Mount Pleasant, South Carolina-based McKnight Law Firm, says that filing a police report is a way for motorists, especially those who likely did not cause an accident, to protect themselves and boost the odds of receiving fair compensation from an insurance claim.

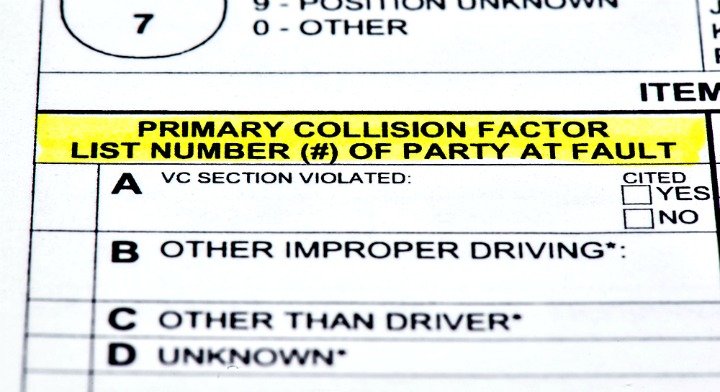

McKnight says that police officers, once they arrive at an accident scene, will gather information from both drivers and any witnesses and put that information into a written report. The insurance companies processing the accident claim can use this information as they begin the process of determining which insurer or insurers will pay out to cover repairs.

CHECK OUT: When’s the Best Time to Buy a Car?

“Having the police show up at the scene makes the insurance claims process easier with all of the information set forth in a collision report,” McKnight says.

If you don’t wait to file a police report, you could even be opening yourself up to a con. Say you and the other driver swap insurance and contact information and agree to both drive away from the scene. McKnight asks an interesting question: What if the driver who was the cause of the accident provides incorrect contact and insurance information? You might then be left with no way to contact this driver or his or her insurer.

And that’s only one possible negative outcome, McKnight says.

“The at-fault party may also decide to change his or her story about what happened after the vehicles have been moved and change his or her version of the facts in their favor,” McKnight says.

If this happens? Your insurance company might end up on the hook for some or all of the damages in a case. And that could mean higher auto-insurance rates for you.

Not filing a police report can damage your claim

Lawrence Buckfire with the Southfield, Michigan-based law firm of Buckfire & Buckfire, says he’s seen firsthand how not filing a police report quickly after an accident can hurt those motorists who didn’t cause the collision.

That’s because some insurance policies specifically require that motorists file a police report within 24 hours of an accident.

“The failure to file a report can prevent you from claiming benefits under the policy,” Buckfire says.

Buckfire points to a case he recently worked on. His client was hit by a driver who had no auto insurance. No one called the police at the scene, with both motorists exchanging contact information and driving their vehicles away from the accident site. Buckfire’s client then waited an entire week before filing a police report.

The court eventually dismissed this client’s case because he did not file a written report within the 24 hours required under his auto insurance policy, Buckfire says, a costly lesson.

Each insurance company has its own procedures and policies on how to file a claim and knowing them can help you when shopping for car insurance.

Police reports don’t always assign blame

If you do file a police report and that report generally corroborates your version of events — and even identifies the other driver as the cause of the collision — don’t think that your insurer won’t necessarily have to pay out some money, too.

RELATED: How the Widow Penalty Affects Auto Rates

Evan Walker, a personal injury lawyer in La Jolla, California, says that the insurance adjusters who handle a claim will usually rely heavily on the information contained in a police report. But this doesn’t mean that the police report will necessarily exonerate you from any responsibility for the accident.

A police report is a guide for adjusters, Walker says. But it’s not always the final word on what exactly happened in a case. Adjusters will still usually call you and the other driver for statements. They might also interview witnesses who were on the scene.

By collecting this additional information, adjusters might come to a different conclusion than the police officer who filed the accident report. And this means that you might incur more responsibility for the accident, even if it appears that the other driver was mostly at fault.

“Injured parties should understand that the police report can be attacked or disregarded by a personal-injury attorney,” Walker says. “I’ve seen that both as a defense attorney and as a plaintiff attorney.”